With this post we inaugurate a series of articles dedicated to the Enterprise Risk Management, in the frame of a collaboration between Antonella Lanati, owner of Valore Qualità, consultant and adjunct professor at Vita-Salute San Raffaele University, and Alberto Bettanti, professor of management engineering at Università degli Studi di Genoa and Pavia, and CEO at Proxima, an independent management consulting company. The topics are taken from their book “ERM Enterprise Risk Management – Nuovi orizzonti per la creazione di valore“, published by McGraw Hill Education Italy and from further detailed authors’ studies.

The starting point for a meaningful risk management process is the correct understanding of risk and its many reverberations within the organization. The knowledge of the phenomenon is crucial to prevent from simply dealing with risk, failing to seize the up-side opportunities stemming from handling the risk as a factor of value creation.

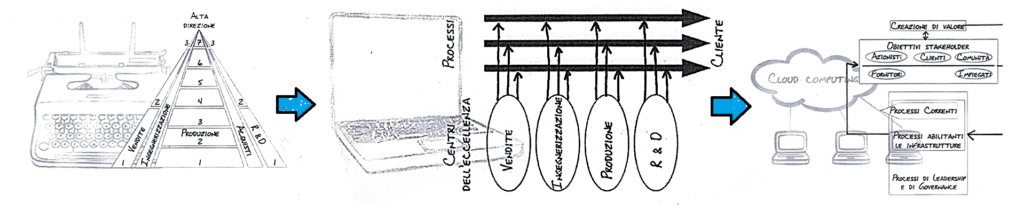

What we will see in this series of articles will point to the ERM ultimate goal: a strategy setting process oriented to maximizing the business value with respect to the risk appetite profile. The first articles will deal with the relationship between the evolution of organizational change and risk management. The evolution of organizational models has guided and supported the evolution of the risk approach, starting from the functional model, through the process-oriented one, to the current stakeholder-oriented model. In the next posts, we will see them in detail.

The first article will be devoted to the relationship between Risk Management and Organization in the ’80s.